Home Affordability Calculator How Much House Can I Afford?

Table Of Content

If you live in a town where transportation and utility costs are relatively low, for example, you may be able to carve out some extra room in your budget for housing costs. While it's true that a bigger down payment can make you a more attractive buyer and borrower, you might be able to get into a new home with a lot less than the typical 20 percent down. Some programs make mortgages available with as little as 3 percent or 3.5 percent down, and some VA loans are even available with no money down at all. Mortgage lenders use a shortcut to calculate mortgage affordability.

Bankrate logo

The 28/36 percent rule is a tried-and-true home affordability rule of thumb that establishes a baseline for what you can afford to pay every month. That means your mortgage payment should be a maximum of $1,120 (28 percent of $4,000), and your other debts should add up to no more than $1,440 each month (36 percent of $4,000). You’ll need to determine a budget that allows you to pay for essentials like food and transportation, wants like entertainment and dining out, and savings goals like retirement.

Property Taxes

Although your DTI and housing expense ratios are important factors in mortgage qualification, other variables impact your monthly mortgage payment and how much you can afford. Eligible active duty or retired service members, or their spouses, might qualify for down payment–free mortgages from the U.S. These loans have competitive mortgage rates, and they don't require PMI, even if you put less than 20 percent down.

How Much Income Do You Need to Buy a $300,000 House?

Expenses that count toward your back-end DTI include housing expenses (listed above) as well as payments on installment loans (auto, student, personal loans …) and minimum credit card payments. Looking at your debt-to-income ratio helps lenders determine a) how much wiggle room you currently have in your budget, and b) how much mortgage you can afford with your existing cash flow. So by all means use a home affordability calculator to estimate your budget. But when you want to get serious about buying, make sure you connect with a mortgage lender who can walk you through your options and help you set a realistic budget for your financial situation. Keep in mind that there’s no one-size-fits-all answer to the question, “How much house can I afford?

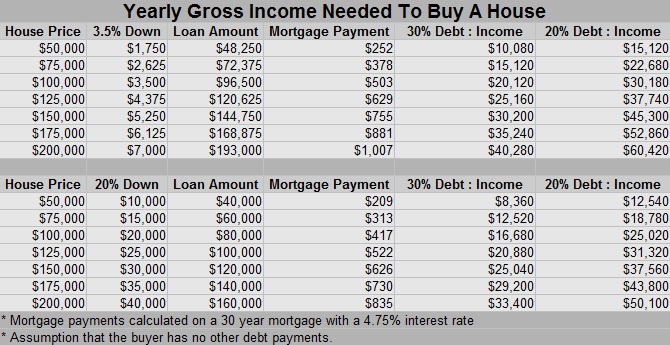

In general, home-buyers should use lower percentages for more conservative estimates and higher percentages for more risky estimates. A 20% DTI is easier to pay off during stressful financial periods compared to, say, a 45% DTI. Home-buyers who are unsure of which option to use can try the Conventional Loan option, which uses the 28/36 Rule.

Home Equity Loan

Loan term (years) - This is the length of the mortgage you're considering. On the other hand, a homeowner who is refinancing may opt for a loan with a shorter repayment period, like 15 years. This is another common mortgage term that allows the borrower to save money by paying less total interest.

Average Cost To Rewire A House In 2024 – Forbes Home - Forbes

Average Cost To Rewire A House In 2024 – Forbes Home.

Posted: Sun, 14 Apr 2024 07:00:00 GMT [source]

If you have a VA loan, guaranteed by the Department of Veterans Affairs, you won’t have to put anything down or pay for mortgage insurance, but you will have to pay a funding fee. You’ll also need to estimate your future home’s utility bills for electricity, gas, trash and water. You might not be paying for all of these expenses where you live now, or you might be paying less for them because you’re in a smaller place than your future home will be.

The larger your down payment and the better your credit score, the lower your PMI rate and the fewer years you’ll have to pay it for. Your loan program can affect your interest rate and total monthly payments. Choose from 30-year fixed, 15-year fixed, and 5-year ARM loan scenarios in the calculator to see examples of how different loan terms mean different monthly payments. Reserves refer to the number of monthly mortgage payments you could make from your savings if you lost your job or experienced another event that impacted your ability to make your payment. Every loan program is different, but a good guideline is to keep at least 2 months’ worth of mortgage payments in your savings account. Now that you’ve looked at your DTI and any debt you may have, think about your budget.

What are the most important factors to determine how much house I can afford?

If you are taking out a conventional loan and you put down less than 20%, private mortgage insurance will take up part of your monthly budget. The PMI’s cost will vary based on your lender, how much money you end up putting down, as well as your credit score. It is calculated as a percentage of your total loan amount, and usually ranges between 0.58% and 1.86%. A mortgage loan term is the maximum length of time you have to repay the loan. It is possible to pay down your loan faster than the set term by making additional monthly payments toward your principal loan balance.

Your DTI compares your total monthly debt payments to your monthly pre-tax income. In general, you shouldn’t pay more than 28% of your income to a house payment, though you may be approved with a higher percentage. How much house you can afford depends on several factors, including your monthly income, existing debt service and how much you have saved for a down payment.

Taking equity out of your home can be a solid financial decision if you are using the funds to push your finances in a positive direction. For example, using your home equity to pay off high-interest credit card debt could lead to savings in the long run. Keep in mind that this total amount can change from lender to lender. Your original mortgage balance is included in the loan-to-value (LTV) ratio, which represents your loan balance divided by your home value. The average time to close a mortgage once you're under contract is 42 days. Her work has been published or syndicated on Forbes Advisor, SoFi, MSN and Nasdaq, among other media outlets.

When determining whether to approve you for a certain mortgage amount, lenders pay close attention to your debt-to-income (DTI) ratio. Typically, when you belong to a homeowners association, the dues are billed directly, and it's not added to the monthly mortgage payment. Because HOA dues can be easy to forget, they're included in NerdWallet's mortgage calculator. Fixed-rate loans have the same interest rate for the entire duration of the loan. That means your monthly home payment will be the same, even for long-term loans, such as 30-year fixed-rate mortgages.

Having less debt can improve your credit score and increase your monthly cash flow. A jumbo loan is used when the mortgage exceeds the limit for Fannie Mae and Freddie Mac, the government-sponsored enterprises that buy loans from banks. Jumbo loans can be beneficial for buyers looking to finance luxury homes or homes in areas with higher median sale prices.

You will have an easier time making your payments, or (better yet!) you will be able to pay extra on the principal and save yourself money by paying off your mortgage early. A good answer would be a home that you won’t regret buying and one that won’t have you wanting to upgrade in a few years. As much as mortgage brokers and real estate agents would love the extra commissions, getting a mortgage twice and moving twice will cost you a lot of time and money.

Because such comparison shopping is the only way to make sure you get a great deal. Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. You’ll have a comfortable cushion to cover things like food, entertainment and vacations.

It’s a good idea to have at least $3,000 to $10,000 saved up to cover these costs or unexpected expenses along the way. There are no set rules regarding how much of your income should cover a mortgage payment. However, lenders will look at how much of your income is going to other outstanding debts before approving another loan. Check out this guide for the different methods for determining how much of your income should go to your mortgage. A key factor in whether or not you can afford a home is based on the mortgage rate offered. And with current mortgage rates doubling in 2022, it has been a top factor in slowing down home purchases heading into 2023.

Comments

Post a Comment